Canadians who live or work abroad or who travel a lot may still have to pay Canadian and provincial or territorial income taxes. If you are planning to be outside Canada for an extended period of time, you should inform the Canada Revenue Agency (CRA) before you go to ask for a determination of your residency status.. A Canadian Certificate of Residency is a document produced by Canada Revenue Agency regarding the tax status of an individual or a business in Canada. Prior to being presented abroad, the Certificate of Residency will need to receive an apostille. Contact us today for information on this often complex process - we are here to assist you!

5000 En France Fill Online, Printable, Fillable, Blank pdfFiller

PA Certificate Of Residency 20162022 Fill and Sign Printable Template Online US Legal Forms

Certificate Of Residency

Apply for Certificate of Tax Residency in Hong Kong (individual)

Tax Residency Certificate 2014 PDF

Tax Residency. Why It Matters and How It Is Determined. Andersen

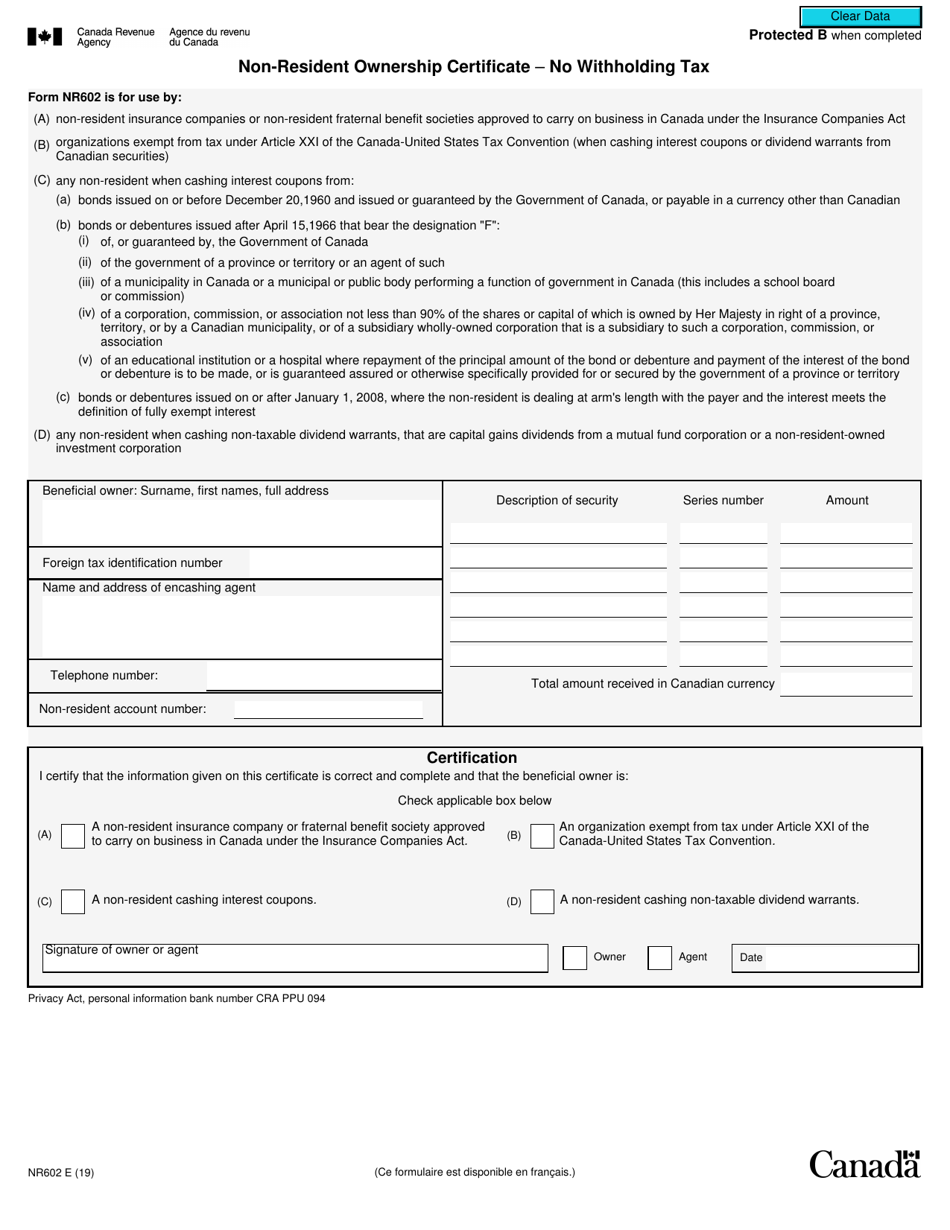

Form NR602 Fill Out, Sign Online and Download Fillable PDF, Canada Templateroller

6

Certificate of residence for tax purposes General topics Forums

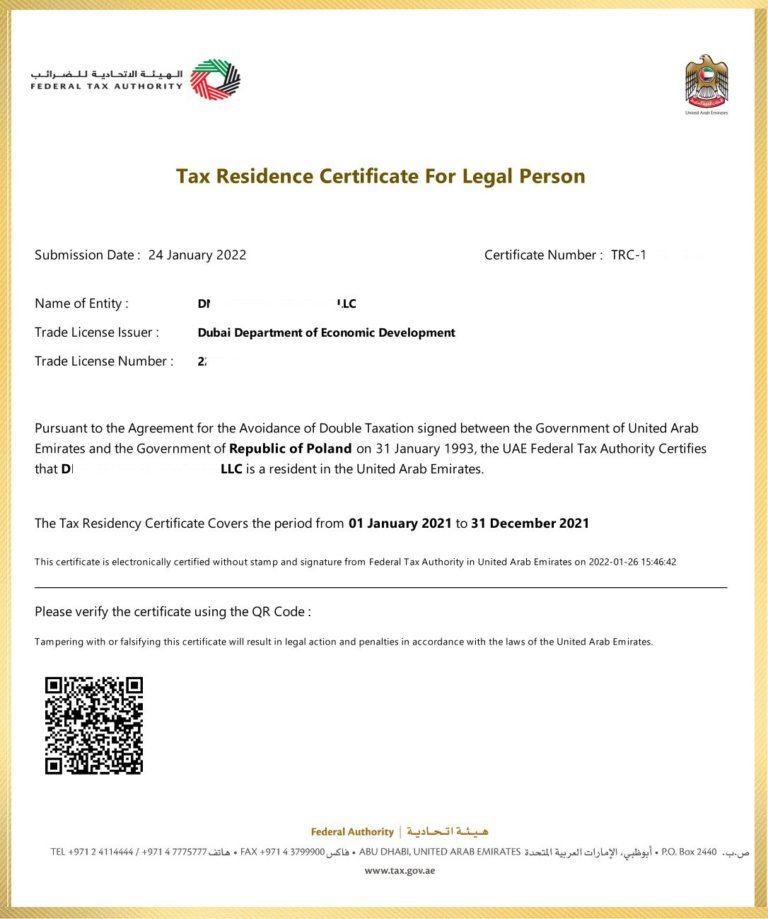

How to apply for Tax Residency Certificate (TRC) in UAE?

Certificate of Residency

Tax residence certificate что это

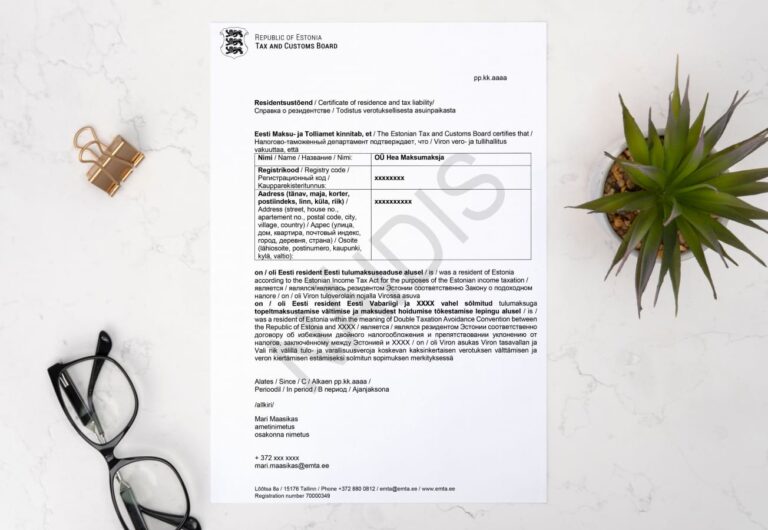

Tax residency certificate Magrat OÜ

Residency Certificate Tax Exemption in Korea tax exemption

High Net Worth Individual in Last Updates PB Services

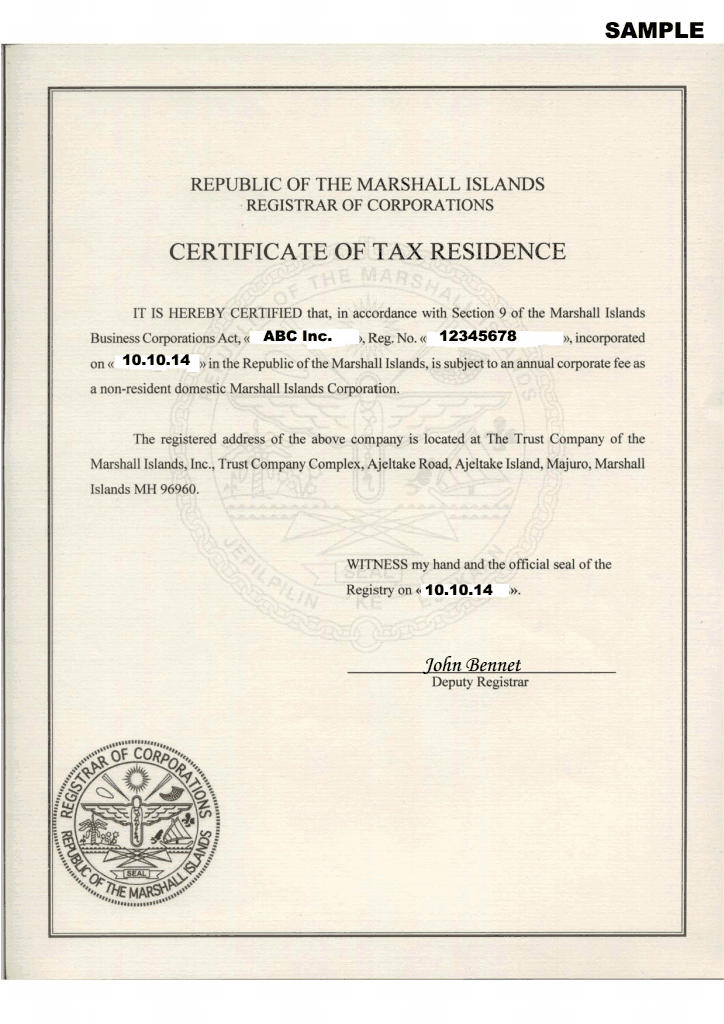

CERTIFICATE OF TAX RESIDENCY Eesti Consulting OÜ

Tax Residency Certificate India TRC Certificate Tax

Tax Residency Certificate Landing page VAT & TAX Consultant , Dubai , UAE The VAT Consultant

UAE Tax Residency Certificate for Individuals and Companies

Tax Residency Certificate MASD

This means that if you were earning $35,000 in taxable income and moved your province of residence from Alberta to Manitoba, you could pay $280 more in provincial taxes (not accounting for personal deductions, credits, or other potential deductions, and not including federal taxes). Alberta: $35,000 x 10% = $3,500.. Section2- Declaration of tax residence. Use Section2 to identify the account holder's tax residence and taxpayer identification number. If the account holder does not have such a number, give the reason. Generally, an individual will be a tax resident of a jurisdiction if they normally reside in that jurisdiction and not just because they.