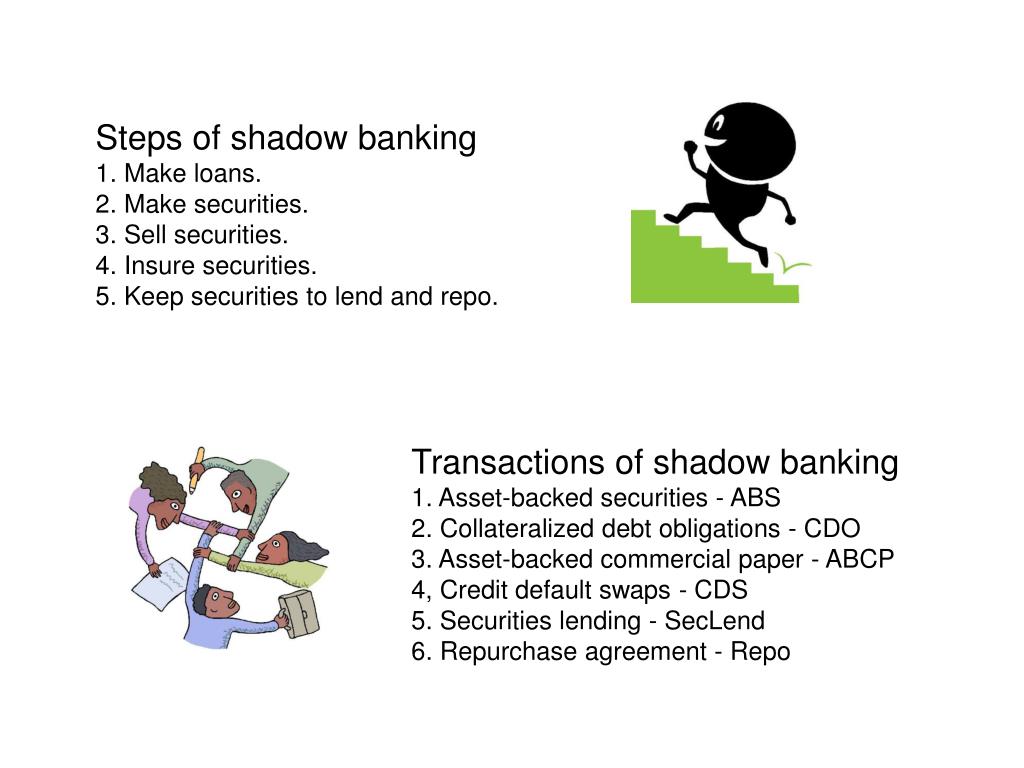

O termo "shadow banking" se refere a um sistema financeiro paralelo que opera fora das instituições bancárias tradicionais. Também conhecido como sistema bancário sombra, esse setor é composto por entidades não bancárias que realizam atividades semelhantes às dos bancos, como empréstimos, investimentos e intermediação financeira.. Often it is not a bank—it is a shadow bank.. Shadow banking, in fact, symbolizes one of the many failings of the financial system leading up to the global crisis. The term "shadow bank" was coined by economist Paul McCulley in a 2007 speech at the annual financial symposium hosted by the Kansas City Federal Reserve Bank in Jackson Hole.

Shadow Banking รายการ innovative wisdom YouTube

Shadow banking Under the regulator’s spotlight BankingHub

Tout comprendre sur le shadow banking Appgroves

Shadow banking o sistema paralelo que financia a economia global

Exemplos De Shadow Banking

O que é Shadow Banking e sua relação com as criptomoedas?

Exemplos De Shadow Banking

Exemplos De Shadow Banking

Shadow Banking SKYROCKETS To 52 Trillion and Completely Out of Control! Major Risk YouTube

How Shadow Banking Affects America Nspirement

Le shadow banking Qu'estce que la finance parallèle ? quel est... Librairie Eyrolles

Exemplos De Shadow Banking

Le "shadow banking", l'autre facette de la finance Selexium

Shadow Banking Is Getting Bigger Without Getting Better Bloomberg

The Shadow banking system. (Based on Singh 2014) Download Scientific Diagram

Why Should You Care About Shadow Banking? Money For The Rest of Us

Shadow Banking Simply Explained YouTube

PPT Shadow Banking PowerPoint Presentation, free download ID1146337

![Shadow Banking o que é? [2024] Shadow Banking o que é? [2024]](https://somas.io/images/artigos/shadow-banking.jpg)

Shadow Banking o que é? [2024]

CONVERSABLE ECONOMIST A Shadow Banking Schematic

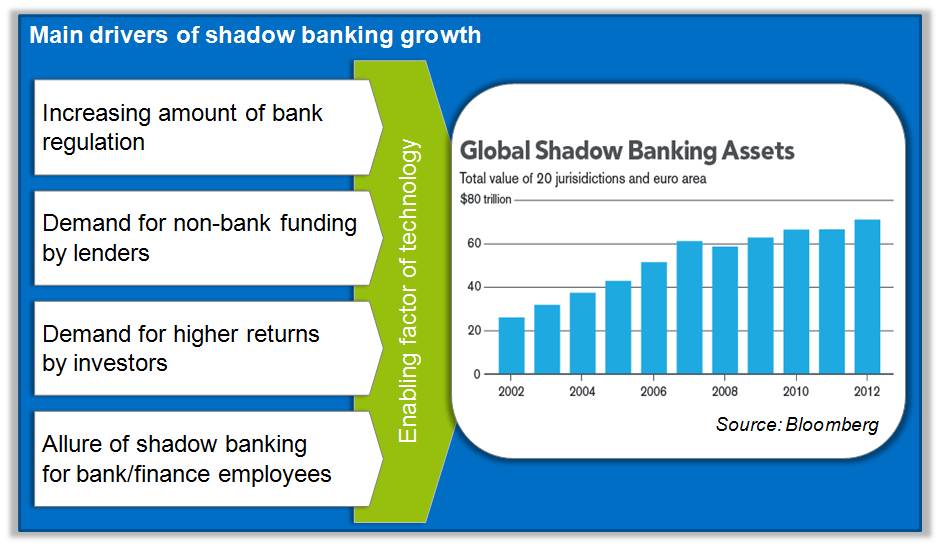

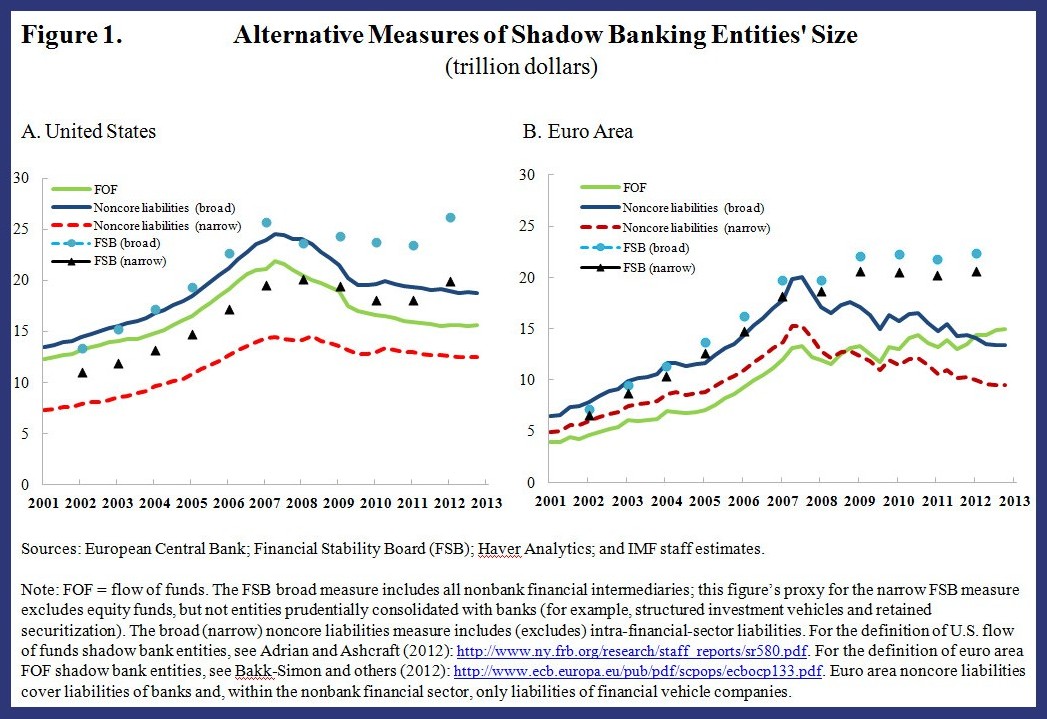

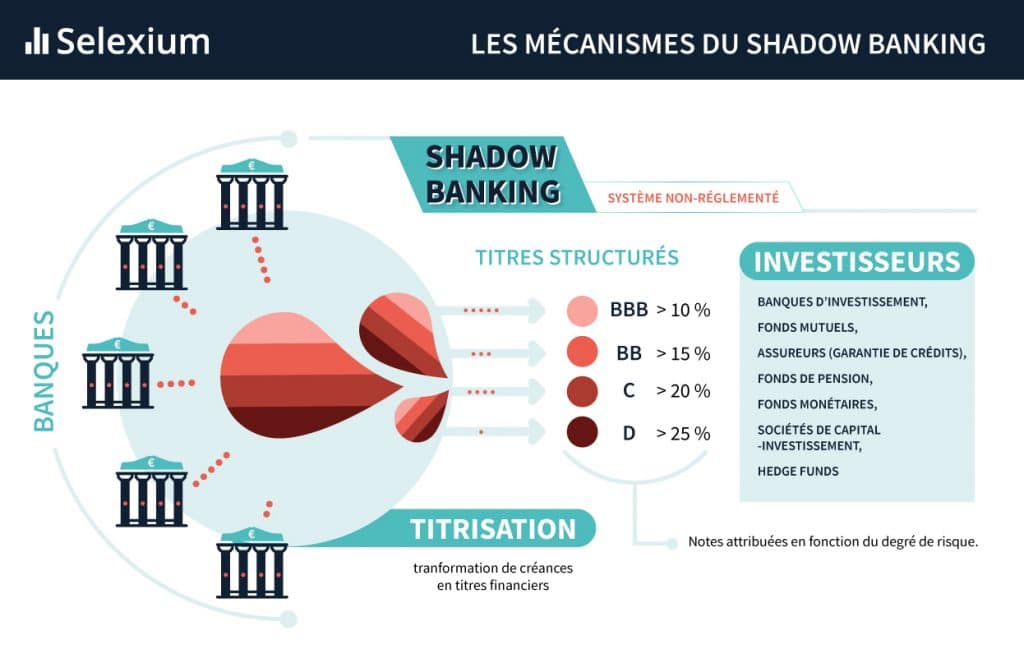

The shadow banking sector requires regulation because of its size (25-30% of the total financial system), its close links to the regulated financial sector and the systemic risks that it poses. There is also a need to prevent the shadow banking system being used for regulatory arbitrage. Since the financial crisis began in 2007-2008, the.. Therefore, shadow banking needs access to a backstop, i.e., a risk absorption capacity external to the shadow banking activity. The backstop for shadow banking needs to be sufficiently deep: First, shadow banking usually operates on large scale, to offset significant start-up costs, e.g., of the development of infrastructure;