Qantas Money Home Loan is currently offering a variable interest rate of 4.67 per cent with a minimum 10 per cent deposit. Its one-year fixed rate is 5.23 per cent, and the two-year fixed rate is.. Fees. Application: $345. Ongoing: $0 p.a. Compare. Points offer. Borrowers can earn 100,000 Qantas points every year, for the life of the loan when they take out a home loan with Qantas. Qantas.

Earn 100,000 Qantas Points every year when you switch to Qantas Money Home Loan Point Hacks

How Home Loan Interest Rates Work Qantas Money Home Loans

When to Refinance Qantas Money Home Loans

What It Costs to Refinance Your Home Loan Qantas Money Home Loans

Different Types of Home Loans Qantas Money Home Loans

Earn 100,000 Qantas Points every year when you switch to Qantas Money Home Loan Point Hacks

Interest Rate vs Comparison Rate Qantas Money Home Loans

Qantas Money Android Apps on Google Play

Qantas Money Android Apps on Google Play

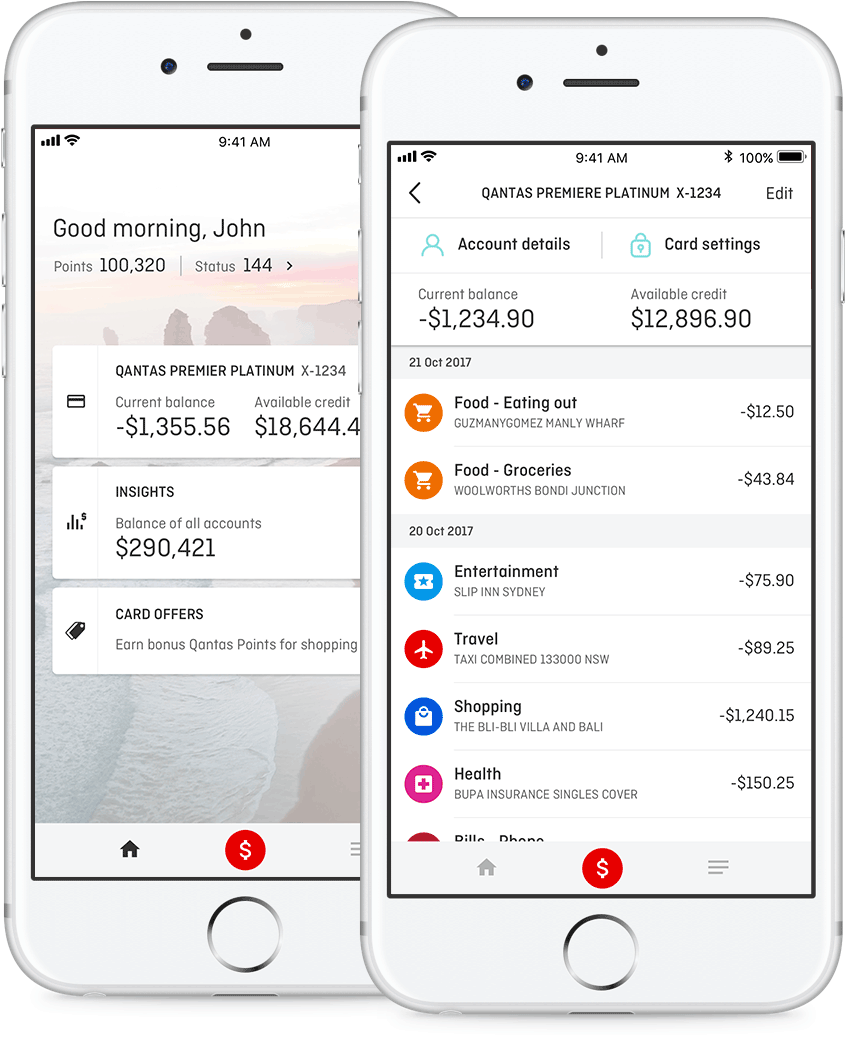

Money Management app Qantas Money

Qantas Money on the App Store

What’s an Offset Account? Qantas Money Home Loans

Offset Accounts & Financial Claims Scheme Qantas Money Home Loans

Qantas Cash

Qantas Premier Everyday Credit Cards Qantas Money

Earn 100,000 Qantas Points a year with the new Qantas Money Home Loan Point Hacks

Qantas Money Premier Everyday Review Travel insurance reviews credit card

Qantas money home loans kworld trend

Qantas Money rolls out home loan offering Your Mortgage

Antonio Addario on LinkedIn We just launched another great product, Qantas Money Home Loan

Important to know. All lending interest rates are for new loans only and may differ for existing loans. Rates are subject to change. Fees and charges may be applicable and can be found on the Rates & Fees page online. The comparison rate displayed is calculated for a Qantas Money Home Loan of $150,000 over a term of 25 years.. The Qantas Money Fixed Home Loan starts with a fixed interest rate of 6.19% p.a. (6.16% p.a. comparison rate*) for one year and is available for loans between $300,000 and $3 million. You can secure a fixed interest rate for one to five years. After the fixed-rate period ends, customers revert back to a 5.78% p.a. variable rate.